Undergraduate Course

- Engineering Economic Analysis - Fall and Spring semesters

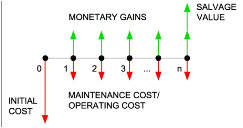

Do you like making money? Would you know how to evaluate different investment opportunities? What level of initial investment in an engineering project makes an opportunity profitable, or what rate of return guarantees investment profitability? The goal of this course is to apply the concept of time value of money to make optimal engineering project investment choices in the face of competing alternatives. This is important because an opportunity with less upfront capital cost today may actually be costlier than that with a higher upfront capital cost when both opportunities are compared over their life cycles. Thus, you will learn how to analyze the financial worthiness of engineering projects and apply engineering economy concepts to make go/no-go decisions.

You will find value in this course because the notion of the time value of money is applicable to your everyday financial decisions. This course will also provide you with the foundation knowledge needed for the Fundamentals of Engineering exam for Professional Engineers and the know-how to conduct life-cycle financial analysis of engineering projects using spreadsheet techniques. Beyond function and performance, engineering solutions must also be viable economically and in the face of resource pressure, financial constraints, and fiscal limitations, the case for extracting information from the available project financing data to make better economic engineering decisions has never been so strong.

Graduate Courses

- Finance for Engineers - Fall semester only

The objective of this course is to provide engineering managers and systems engineers with a basic understanding of corporate The objective of this course is to provide engineering managers and systems engineers with a basic understanding of corporate finance with emphasis on the concepts and techniques for analyzing a firm’s sources and uses of funds, management of working capital, leverage, valuation, financial forecasting, and investment decisions. This course is built on the premises that (i) financial concepts and techniques need not be abstract or obtuse, (ii) recent advances in the field such as agency theory, market signaling, market efficiency, capital asset pricing, and real options analysis are important to practitioners, and that (iv) finance has a lot of inputs into the broader aspects of company management.

There are five main parts in this course. Part 1 sheds light on the management of existing

resources. This part deals with the use of financial statements and ratio analysis to assess a

company’s financial health (evaluating a firm’s strengths, weaknesses, recent performance, and

future prospects). The overarching theme in this part is that a business must not only be viewed as

an integrated whole, but also effective financial management is feasible by evaluating the firm’s

operating characteristics and strategies. Part 2 begins the rest of the course that focuses on the

acquisition and management of new resources by exploring financial forecasting and planning with

emphasis on managing growth. Part 3 examines the financing of company operations, including a

review of the principal security types, the markets in which they trade, and the proper choice of

security type. Part 4 dives into understanding the use of discounted cash flow techniques to

evaluate investment opportunities, and considers the influence of risk in investment

appraisal. In the final part, the course examines business valuation and company restructuring.

- Uncertainty Analysis in Cost Engineering - Spring semester only

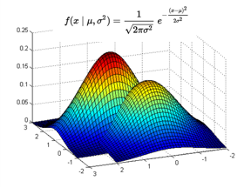

When systems engineers or engineering managers consider how systems are designed, developed, produced, and maintained, a major consideration in their decision making is cost. Thus, it becomes central and critical to understand how uncertainty affects a system's cost. The objective of this course is to provide engineering managers and systems engineers with a basic understanding of probability methods and the basic skills for developing probability models to perform meaningful engineering economic studies, financial feasibility assessments, and cost uncertainty analysis in the planning phase of engineering projects.

The objective of this course is to provide you, engineering managers and systems engineers, with a basic understanding of probability methods and the basic skills for developing probability models to perform meaningful engineering economic studies, financial feasibility assessments, and cost uncertainty analysis in the planning phase of engineering projects. At the onset, the notion of quantifying uncertainty may appear puzzling, i.e., how can we analyze what we do not know? The answer to this question lies in the description of uncertainty with the language of probability theory. In this course, we will approach the representation of uncertainty, quantitatively, with the aid of probabilities. You will be given an in-depth introduction to the basic ideas of probability theory and, by extension, you will also learn how probability theory can be applied to gain understanding and insights into practical decision problems. This is even more important in recent times because of the critical impact of uncertainty on decision-making especially in the formulation of competitive strategies and financial investment plans. We will integrate some ofmay be confronted with in your managerial careers. In the first segment of the course, we will focus on the traditional approaches to probability theory into practical decisions under uncertainty just as you analytical and closed form equations from probability theory. In the second segment, we will explore the use of simulation modeling for problems with structures without closed form equations.

Proposed

- Bayesian Reasoning and Machine Learning (Graduate)